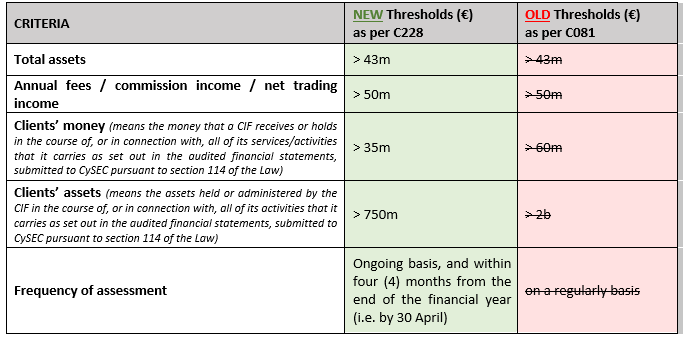

Through the Circular, CySEC informs the Cypriot Investment Firms (“CIFs”) that Circular C081 issued on 28.07.15 regarding the threshold criteria of “significant CIF”, is repealed and replaced with the present Circular. Through the present Circular, CySEC redefines the thresholds that a CIF can use to objectively determine whether it is a “significant CIF” and the frequency of such assessment, in order to decide whether the below specified requirements that apply to a “significant CIF” (see Point A below) shall be fulfilled:

A. Requirements that apply to a “significant CIF”:

- Section 12(5) of Law 144(I)/2007 on the limitations on the number of directorships an individual may hold;

- Section 8A(2)(a) of Law 144(I)/2007 on the establishment of a Nomination Committee;

- Section 6 of Directive DI144-20007-08 on the establishment of an Independent Risk Committee;

- Section 22 of Directive DI144-20007-08 on the establishment of an Independent Remuneration Committee.

B. Definition of “significant CIF”

CySEC’s expects that: CIFs must, within four (4) months from the end of their financial year, assess whether they become a “significant CIF” according to the results of their audited financial statements. If a CIF meets the relevant threshold criteria, then it is considered as a “significant CIF” until the next assessment made according to the audited financial statements of the following year. If a CIF becomes aware that it becomes a “significant CIF”:

- it must immediately make arrangements to establish and have in place sound, effective and comprehensive strategies, processes and systems to achieve compliance with the requirements that apply to a “significant CIF” (see Point A above);

- it must inform CySEC in writing;

- it must submit its new Organisational Diagram to CySEC.

CySEC may, on a case by case basis, require a CIF which does not meet any of the criteria that apply to a “significant CIF” (see Point A above), to comply with the requirements that apply to a “significant CIF”, if CySEC considers it appropriate.

A CIF may apply to CySEC (request in writing) to waive any one or more of the criteria that apply to a “significant CIF” (see Point A above), if it believes that one or more of the governance requirements specified and which apply to a “significant CIF” may be disproportionate to it. In CIF’s written application for such waiver, CySEC expects the CIF to demonstrate, taking into account the size, internal organisation and the nature, scale and complexity of its activities, why it should not be considered as a “significant CIF”. It is noted that the effect of such waiver is that the CIF would not be a “significant CIF” only for the purpose of the particular governance requirement(s) that apply to a “significant CIF” (see Point A above) that the waiver is expressed to apply to (for the avoidance of doubt, such CIF would still be a “significant CIF” for the purpose of the other requirements that apply to a “significant CIF”.